Compare Auto Rates from Top Rated Carriers

Everything You Need to Know About PIP (Personal Injury Protection) Insurance

Below you will find a comprehensive description of Personal Injury Protection insurance from the definition to the extent of coverage you should get.

All auto insurance providers are compared simultaneously.

- PIP (Personal Injury Protection) Insurance

- Personal Injury Protection Insurance Defined

- When Do You Need Personal Injury Protection Insurance?

- Personal Injury Protection Insurance Coverage Span

- How Much Is Covered Under Personal Injury Protection Insurance?

- You Need To Have Personal Injury Protection Coverage in the Following States

- The Cost of Personal Injury Protection Coverage

PIP (Personal Injury Protection) Insurance

In case of an accident, PIP (Personal Injury Protection) insurance is designed to cover the medical costs for you as well as for your passengers.

Are you interested in Personal Injury Protection insurance? To find the most affordable rates for car insurance, click here.

Personal Injury Protection Insurance Defined

In the event of a car accident and without considering who is at fault, PIP insurance is the car insurance component that covers losses associated with loss of work and medical costs incurred by you and any passengers involved. Since it covers injuries without considering who is at fault, Personal Injury Protection insurance is required in “No-Fault” jurisdictions.

When Do You Need Personal Injury Protection Insurance?

- If the passengers you have with you in your vehicle sustain injuries after an accident, they may hold you responsible for any related medical costs.

- If your health insurance is lacking, you might benefit from having Personal Injury Protection coverage. Reach out to your healthcare provider to find out whether you have enough health care insurance to reduce your need for Personal Insurance Protection insurance significantly.

Personal Injury Protection Insurance Coverage Span

Your medical costs include medication, ambulance fees, treatment, surgical, and other medical fees/charges.

Your passengers will be covered to the limit of the policy regardless of whether you have caused the accident or not, as PIP insurance provides the “No-Fault” coverage. Therefore, rehabilitation costs and lost wages can also be recovered through Personal Injury Protection coverage.

How Much Is Covered Under Personal Injury Protection Insurance?

Depending on the state you live in, Personal Injury Protection insurance offers a varying amount of benefits and different levels of coverage. Up to a maximum of $10,000 Personal Injury Protection insurance normally covers 60 percent of losses occasioned by the loss of work and 80 percent of medical costs in the state of Florida

For example, having an idea of the amount of Personal Injury Protection insurance you require is essential. For detailed information, reach out to your insurance provider or agent.

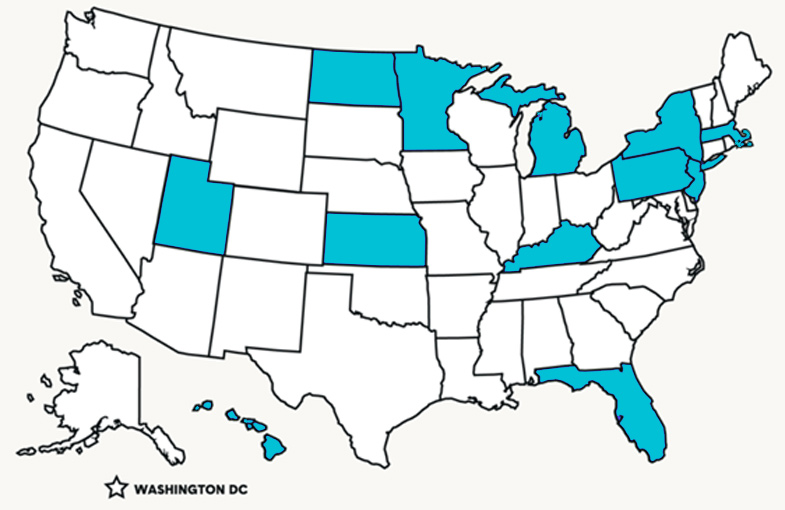

You Need To Have Personal Injury Protection Coverage in the Following States

The Cost of Personal Injury Protection Coverage

Location, insurance provider, car type, and age are some of the factors influencing the cost of Personal Injury Protection coverage. For pricing and estimates from top-rated insurance providers, input your ZIP code at Insurance Online.

One of the Insurance Online resident insurance pros compiled this article. To ensure that we only publish accurate information for our audience, each article is vetted thoroughly. This is insurance in plain terms.

Sandra Cruz | Linkedin

Based in Newport Beach, CA, Sandra has been a licensed insurance agent in California and Texas for 5 years and is an editor and writer specializing in all types of insurance matters. Sandra is Insurance Online's authority on auto, home, and business insurance and has been featured in publications such as Forbes, Yahoo! Finance, and US World News Report.

Start Saving Now

Buy Online

Our easy-to-use tool lets you compare quotes from top providers, all at once and online.

OR

Connect with an Agent

Whether you just prefer a friendly voice or need more information, our licensed agents are ready to help you save.

(800) 956-8611